NOTICE: Internet Explorer was retired by Microsoft on June 15th, 2022 and is no longer supported. This could change how you access Online Banking.

Credit Scores 101

Credit Scores 101

Your credit score affects whether you can get a loan or credit card, how much you can borrow, and what rate you’ll pay. Here’s what you need to know about that 3-digit number:

The 5 Factors That Affect Your Credit Score1

35%Payment HistoryPaying on time |

30%Credit UseDon’t max out |

15%Credit HistoryThe longer you’ve |

10%Types of CreditCredit cards. Car |

10%New CreditA lot of new credit |

How Is Your FICO Credit Score Calculated?

Today, we have three main credit agencies that calculate individual credit reports: Experian, Equifax and TransUnion. Each of the three main credit agencies calculate your personal credit score based on your credit report at that individual agency. Each agency has over 200 million credit history files for individuals who have borrowed in the past. 4.5 billion of those files are updated every month. The agencies tend to have different information in their files, which means your credit report and score will vary from agency to agency.

Those credit scores are what potential creditors, landlords, employers and insurers look at for an instant judgment on your creditworthiness. Creditworthiness implies how likely you are to pay back what you borrow based on your history. That’s why better credit reports and higher credit scores make it easier and cheaper to borrow. It also makes it easier to rent an apartment or buy a house, get a job, purchase insurance, open a credit card and more.

How Do I Build Credit?

A good credit score has a major impact on your finances, so it’s important to start out strong. In this Coach session, learn how to build a credit score for the first time or boost an already decent score, and create a plan with options that work for you. To begin, select Get Started. Follow the prompts, answer the questions, and provide information when asked.

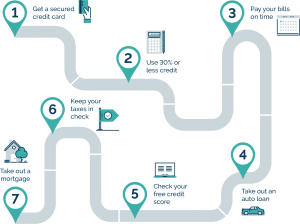

Your Path to Building a Better Credit Score

Now that we have covered what goes into your credit score, it may be easier to visualize the path you could take on your credit building journey. From getting the best cell phone plans and securing an apartment lease to getting a great rate on a mortgage or car loan, your credit score can help you leverage great deals. Here’s your map to put you on the path to a better credit score.

Two Ways to Avoid a Bad Credit Score

There are two common ways that your credit score can be impacted in a bad way. The first is not using credit responsibly, which happens often with misusing credit cards. That means spending more than you can afford, not paying your bill on time and having too much outstanding credit. That outstanding credit is often spread across multiple credit card accounts. Credit cards are a great way to build your credit score when used responsibly. Learn more about the best ways to use your credit here.

Another way that you may have a low credit score is if you don’t use credit at all. Maybe you’ve never needed to borrow money or weren’t interested in opening a credit card. That means you won’t have a credit history, so borrowers can’t determine how likely you are to pay back what you borrow.

So, if you’re looking to build your credit score, start small by opening a credit card and paying off the balance in full every month. After a few months of making small charges and paying them off, you’ll start to see your score soar.

That’s the thing about credit, you have to use it to build it. Want to get started? Click the button below to look at some credit card options offered be WesBanco.

Explore Credit Card OptionsExplore Credit Card Options

1 Credit data used to calculate a FICO® Score, the score used in more than 90% of lending decisions.

Content is for informational purposes only and is not intended to provide legal or financial advice. The views and opinions expressed do not necessarily represent the views and opinions of WesBanco.

While we hope you find this content useful, it is only intended to serve as a starting point. Your next step is to speak with a qualified, licensed professional who can provide advice tailored to your individual circumstances. Nothing in this article, nor in any associated resources, should be construed as financial or legal advice. Furthermore, while we have made good faith efforts to ensure that the information presented was correct as of the date the content was prepared, we are unable to guarantee that it remains accurate today.

Neither Banzai, Strategy Academy nor its sponsoring partners make any warranties or representations as to the accuracy, applicability, completeness, or suitability for any particular purpose of the information contained herein. Banzai, Strategy Academy and its sponsoring partners expressly disclaim any liability arising from the use or misuse of these materials and, by visiting this site, you agree to release Banzai, Strategy Academy and its sponsoring partners from any such liability. Do not rely upon the information provided in this content when making decisions regarding financial or legal matters without first consulting with a qualified, licensed professional.

Explore WesBanco Insights

Discover how WesBanco can help you prepare for the road ahead. Gain exclusive insights and learn how to achieve your financial goals.

Education & Insights