NOTICE: Internet Explorer was retired by Microsoft on June 15th, 2022 and is no longer supported. This could change how you access Online Banking.

Economic Outlook Third Quarter 2023

Mixed Readings for the First Half

Robert McGee, CFA® | SVP & Chief Investment Strategist

Contents

- Resilient Labor Market and U.S. Consumer

- Economic Growth Better than Expected

- Focus on the Federal Reserve

- Divergent Readings in the ISM Surveys

- Financial Markets Mixed for the Quarter

- Our Thoughts

Resilient Labor Market and U.S. Consumer

July 26, 2023 — For the first half of 2023, the unemployment rate has averaged 3.5% with the June reading at 3.6%. Both remain near their 50-year lows. May’s nonfarm payroll report was disappointing relative to the Bloomberg consensus forecast, but it was still strong compared to historical readings. Nearly 209,000 new jobs were added in May, versus the six-month average of 278,200. This compares to the pre-pandemic, 3-year average of 177,000.

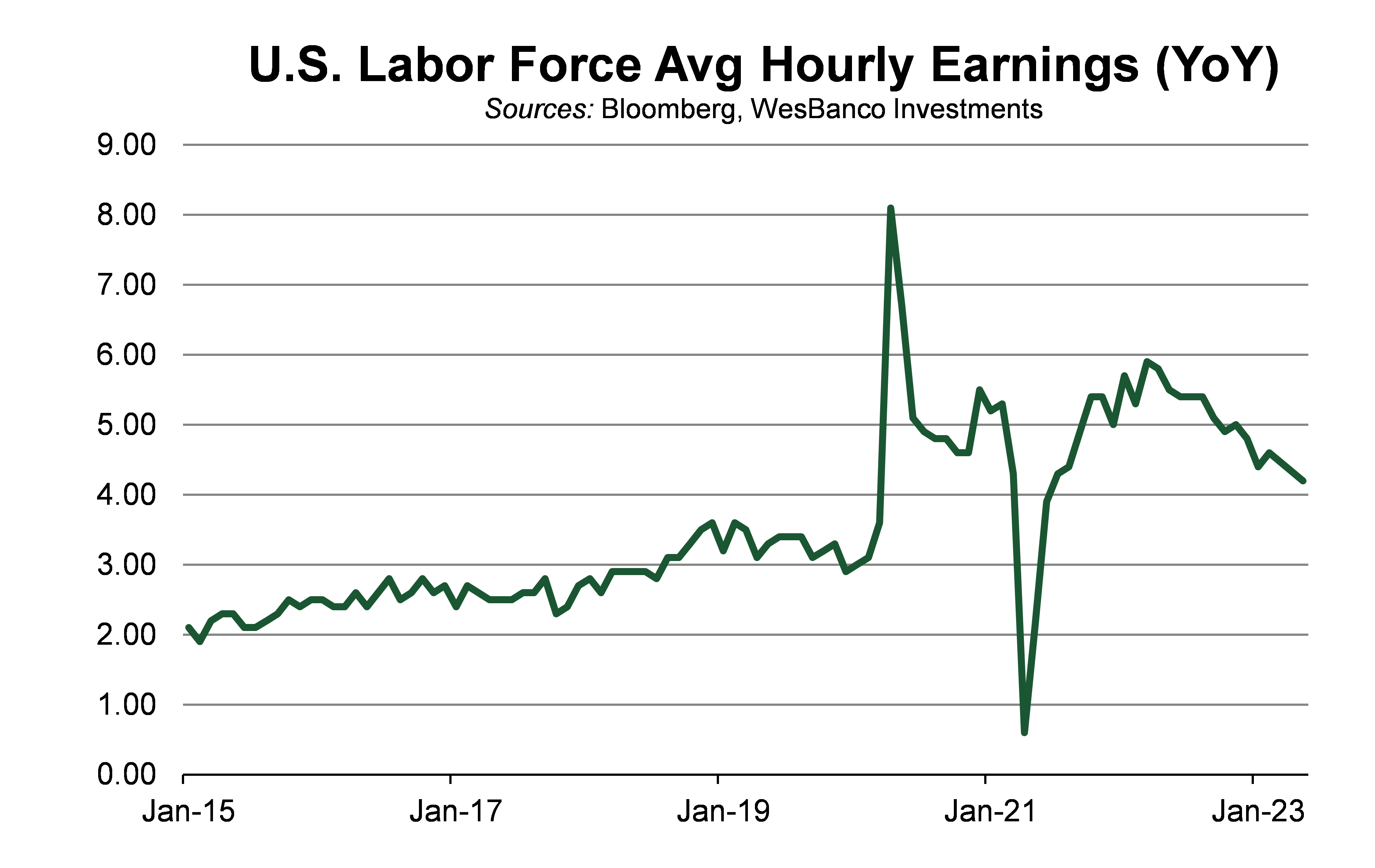

The low unemployment rate combined with hiring has led to higher-average hourly earnings, increasing 4.4% year-over-year. This year-over-year increase is down compared to its 5.9% peak in March 2022, but it still puts pressure on inflation. Labor force participation has remained steady at 62.6% for the fourth straight month.

May retail sales were better than expected, with a top-line, month-over-month reading of 0.3% versus the survey-reported 0.2% decline. The current month reading showed slightly below April’s reading of 0.4%. Excluding autos and gas, the month-over-month reading of 0.1% was in-line with the Bloomberg consensus estimate and the April reading of 0.4%.

The retail sales control group, which directly relates to consumer spending within Gross Domestic Product (GDP), reported a month-over- month gain of 0.2%. That compares to April’s revised reading of 0.6%.

Additionally, retail inventories saw a notable uptick at 0.8% month-over-month, well-above the Bloomberg survey and April reading of 0.2%. Inventories will likely be an important indicator for demand moving forward as they are indicative of demand trends.

Economic Growth Better than Expected

First-quarter GDP growth has been revised higher to 2.0% versus the prior reading of 1.3% and was above the Bloomberg forecast of 1.4%. Consumer spending increased from the prior reading of 3.8% to 4.2%. Residential investment improved versus the prior reading while nonresidential investment declined. The personal consumption expenditures (PCE) price index, excluding food and energy – an important metric for the Federal Reserve – increased 4.9%.

The housing market continues to be resilient in the face of rising mortgage rates. A strong May had housing starts up 21.7% month-over-month versus the consensus estimate of a 0.1% contraction. April was revised lower from 2.2% to -2.9%, but a strong performance in May overshadowed the revision.

Existing home sales also improved, up 0.2% month-over-month, above the survey of -0.7% and the prior month revision of -3.2%. Housing starts hit their highest level since April 2022 at 1.63 million for May. Pending home sales were one of the only slightly negative readings at -2.7% month-over-month versus the prior month’s unchanged reading. It is worth noting that in July, the average 30-year fixed mortgage surpassed the highs seen in November 2022, with the most recent reading at 7.38%.

Focus on the Federal Reserve

According to the Federal Reserve Open Market Committee, its goal is to “seek to achieve maximum employment and inflation at the rate of 2 percent over the longer run.”

As part of the announcement to leave rates unchanged, this Federal Reserve committee noted that the economy is growing at a moderate pace and job gains have been robust. Inflation remains elevated. The Federal Reserve Open Market Committee reiterated its commitment to returning inflation to its 2% objective. The committee will monitor readings in labor markets and inflation pressures to decide on further rate changes. Inflation and job growth will continue to cause market movements as investors watch the same data and make decisions on changing expectations.

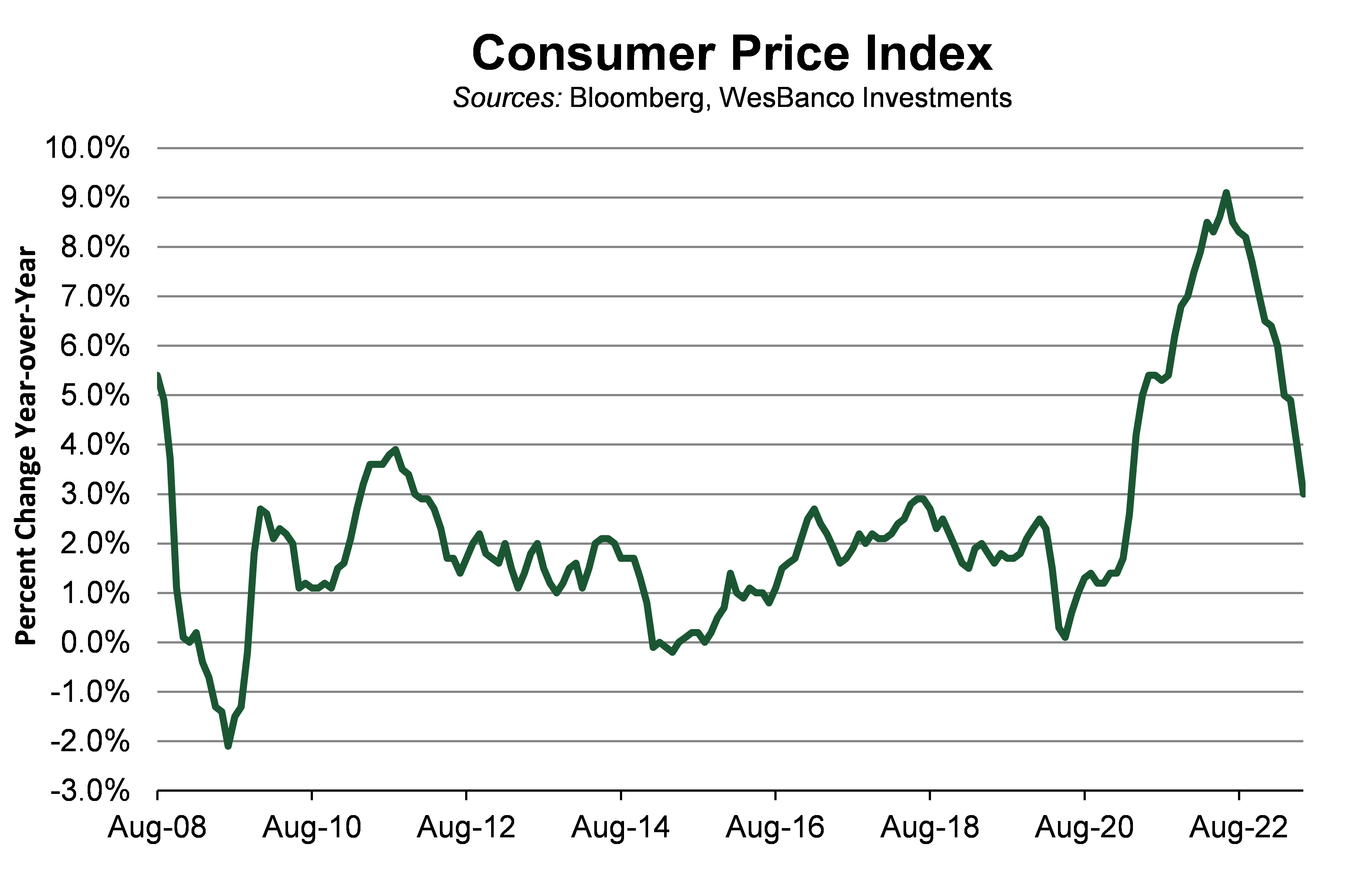

Over the past several months, decreased inflationary pressures have allowed the Federal Reserve to pause its rate hiking cycle. When the Federal Reserve started raising interest rates, inflation measured by the Consumer Price Index (CPI) was 7.9% on a trailing year-over-year basis, before reaching a high of 9.1% in June 2022. The June 2023 CPI reading reported a year-over-year increase of 3.0%, a sharp contrast to earlier levels. The slowing growth in prices has allowed the Federal Reserve to leave rates unchanged in June at a targeted range of 5.00%- 5.25%. The Fed Funds rate had increased from 0.00%-0.25% in the first quarter of 2022 to reach its current levels in five quarters. This is the fastest increase in recent history.

Moderation of inflation has come from fading supply chain disruptions, and specifically declining energy and industrial metals prices, both down double digits year-to-date. The economy is still showing strength from service sectors. With a tight labor market, wage rates continue to increase putting pressure on inflation.

U.S. consumer inflation, job growth, and wage gains have continued to decelerate. We are watching to see if this trend continues because of the Federal Reserve’s aggressive rate increases. The economy is holding up better than expected, but the odds of a recession have increased. The U.S. economy should continue to grow at a moderate pace but any sudden changes may push growth negative.

Divergent Readings in the ISM Surveys

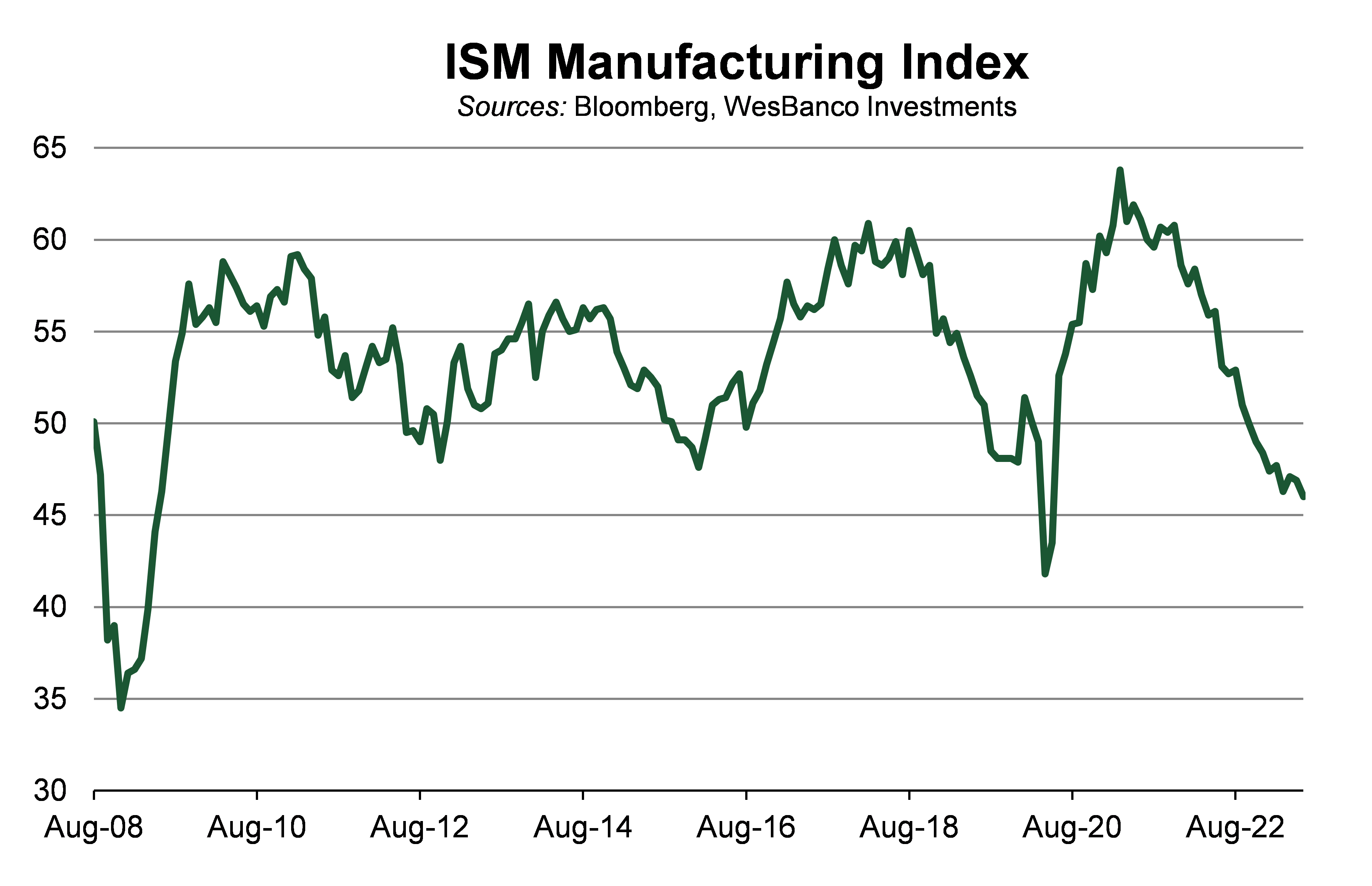

The discrepancy between the ISM Services Index and the ISM Manufacturing Index became more pronounced in June. The spread between the two readings reached 7.9.

This marked the widest spread since August 2015. The ISM manufacturing reading in June of 46.0 was below the survey of 47.1 and the prior month of 46.9, its lowest level since May 2020. Each of these are below the traditional recession-indicator of 50.0.

Conversely, the June ISM services reading of 53.9 was above the Bloomberg consensus estimates of 51.2 and the May reading of 50.3. This is another indicator of how strong the service sector is doing.

We continue to monitor the two indicators for signs of a potential recession, as the strong services sector could delay a potential recession. Or it could turn out to be a lagging economic indicator.

Financial Markets Mixed for the Quarter

Equity markets continued to rally, led by large technology companies and the anticipation of an artificial intelligence boom. Valuations moved higher in equities as prices rallied and overall company earnings declined. Large cap growth stocks spearheaded the rally as the year-to-date rebound remained narrow.

The top 10 largest U.S. stocks, concentrated in technology and communications, rose more than 40% in the first half of the year. This was partly driven by investor enthusiasm about the prospect for artificial intelligence. This far outpaced the rest of the S&P 500 Index, which saw a year-to-date gain of 16.9%.

The small-cap index, as represented by the Russell 2000, gained 8.1%. First-quarter earnings on the S&P 500 Index continued to decline and estimates for second-quarter earnings are expected to be down 7.5% versus a year ago.

Many of the broad market gains in the quarter can be attributed to things being better than expected. Nearly 78% of the companies in the S&P 500 reported better than expected first quarter earnings. The quarter ended with the S&P 500 Index trading at 20.5x 2023-projected earnings, while the Russell 2000 Index traded at 15.9x 2023 earnings. Global earnings growth remained challenged by above-target inflation and monetary tightening. This is expected for the rest of the year, but guidance and commentary will be closely watched. This could create some volatility in stock prices.

Commodities reported modest losses in the second quarter as most categories declined over the trailing three months. Price per barrel of oil dropped despite a surprise production cut from Saudi Arabia. Crude oil fell 5.2% in the quarter, and it was down 12.4% on a year-to-date basis. Gold declined 3.1% as inflation numbers continued to decelerate. Financial markets were less volatile relative to the first quarter.

In fixed income markets, the Bloomberg Barclays U.S. Aggregate Bond Index reported a 0.84% decline for the second quarter. The strong economy and hope of a near-term end to rate hikes led investors to embrace riskier assets. The 10-year Treasury yield moved from 3.47% on March 31, 2023 to 3.83% on June 30, 2023. The 3-month Treasury increased from a 4.80% yield to 5.33% over the same period. The yield curve remains inverted which has historically been a leading indicator of a recession. For reference on the broad fixed-income market, the yield to maturity on the Bloomberg Barclays U.S. Aggregate Bond Index is 4.81% as of June 2023.

Our Thoughts

The markets and economy are at an inflection point all tied to the Federal Reserve. Have they raised interest rates enough without causing a recession?

The market shows that rates have slowed inflation, but the economy is still projected to see a mild recession in the first half of 2024. As interest rates have moved higher, and stock market returns have exceeded expectations, we believe a neutral stance in allocations is warranted.

WesBanco Bank, Inc. is a Member FDIC. WesBanco Trust and Investment Services, a division of WesBanco Bank, Inc., may invest in insured deposits or nondeposit investment products. Nondeposit investment products are not insured by the FDIC or any other government agency, are not deposits or other obligations of, or guaranteed by any bank or any affiliate, and are subject to investment risks including the possible loss of the principal amount investment.

Talk Retirement Planning

Whether you’re opening a new retirement account or interested in rolling over funds, our retirement planning services team can help you make sure you find the right IRA to save for the future. Find a Local Branch and stop by or set up an appointment today.

Locations